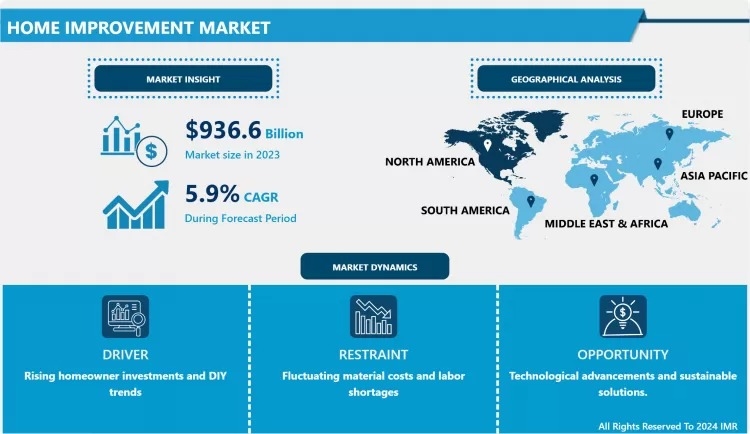

According to a new report published by Introspective Market Research, Home Improvement Market by Project Type, Product, and Mode of Purchase, The Global Home Improvement Market Size Was Valued at USD 936.6 Billion in 2023 and is Projected to Reach USD 1481.6 Billion by 2032, Growing at a CAGR of 5.90%.

Market Overview

The global home improvement market is experiencing a powerful and sustained expansion, driven by a confluence of demographic shifts, technological advancements, and evolving consumer priorities. The home improvement industry encompasses a vast array of products, materials, and services used to renovate, repair, remodel, and enhance residential properties. This market offers significant advantages over the alternative of purchasing new homes, including cost-effectiveness, personalization to exact tastes, and the ability to increase property value. From DIY-friendly painting kits to full-scale professional kitchen remodels, the scope of home improvement caters to a wide spectrum of needs and budgets.

Growth Driver

The most significant driver for the home improvement market is the enduring trend of hybrid and remote work, which has permanently altered how consumers view and utilize their living spaces. The home has transformed into a multifunctional hub for work, education, fitness, and leisure, creating a powerful demand for renovations that support this new lifestyle. Homeowners are actively investing to create dedicated home offices, upgrade technology infrastructure, enhance outdoor living areas for relaxation, and reconfigure layouts for better functionality and comfort. This shift has moved home improvement from a discretionary or maintenance-driven expense to a necessary investment in quality of life and productivity, unlocking substantial spending on both DIY projects and professional contracting services.

Market Opportunity

A paramount market opportunity lies in the accelerating convergence of home improvement and smart home technology. There is massive potential for integrated solutions that combine traditional renovation with automation, energy management, and security. This includes smart HVAC systems, lighting, security cameras, and leak detectors that are increasingly being installed during remodeling projects. The opportunity exists for retailers and contractors to become advisors and integrators of these technologies, offering bundled packages. Furthermore, the growing consumer demand for sustainable and eco-friendly materials—such as low-VOC paints, energy-efficient windows, and recycled building products—presents a lucrative niche. Companies that can effectively market the long-term cost savings, health benefits, and environmental impact of green home improvements are poised to capture a loyal and expanding customer base.

The Home Improvement Market is segmented on the basis of Project Type, Product, and Mode of Purchase.

Project Type

The Project Type segment is further classified into DIY (Do-It-Yourself) and DIFM (Do-It-For-Me). Among these, the DIY sub-segment is a dominant force, particularly in terms of transaction volume and growth in certain product categories. The DIY trend is fueled by the abundance of online tutorials, the desire for cost savings, and the personal satisfaction derived from hands-on projects. A wide availability of user-friendly products and tools at major retailers empowers homeowners to tackle projects from painting and flooring to furniture assembly and smart device installation, driving consistent sales in core retail channels.

Product

The Product segment is further classified into Building Materials, Decor & Indoor, Kitchen & Bath, Outdoor, and Tools & Hardware. Among these, the Building Materials sub-segment accounted for the highest market share. This category forms the foundational core of the industry, encompassing lumber, roofing, siding, windows, doors, insulation, and concrete. Demand is driven by both large-scale remodeling projects, room additions, and essential home repairs and maintenance. The critical nature of these materials for structural integrity, energy efficiency, and weatherproofing ensures steady, high-value demand from both professional contractors and serious DIY enthusiasts.

Some of The Leading/Active Market Players Are-

- Home Depot, Inc. (USA)

- Lowe's Companies, Inc. (USA)

- Kingfisher plc (UK)

- Ace Hardware Corporation (USA)

- Bauhaus GmbH (Germany)

- Menard, Inc. (USA)

- Travis Perkins plc (UK)

- Ferguson plc (UK)

- Bunnings Group (Australia)

- HORNBACH Holding AG (Germany)

- 3M Company (USA)

- Mohawk Industries, Inc. (USA)

- Sherwin-Williams Company (USA)

- and other active players.

Key Industry Developments

News 1:

In February 2024, The Home Depot launched a new digital tool powered by augmented reality (AR) to help customers visualize paint colors and flooring options in their own homes in real-time.

This technology enhances the online shopping experience, reduces purchase hesitation, and bridges the gap between digital browsing and physical project execution, driving sales in key decor categories.

News 2:

In January 2024, Lowe's announced a major strategic partnership with the National Association of Home Builders (NAHB) to better serve professional contractors through dedicated pro services, enhanced fulfillment, and job site delivery.

This move strategically targets the high-value DIFM (Do-It-For-Me) segment, aiming to capture more market share from professional builders and remodelers by catering specifically to their business needs.

Key Findings of the Study

- The Building Materialsproduct category and robust DIY project segment are primary market pillars.

- North Americaholds the largest market share, with strong growth observed in the Asia-Pacific region due to urbanization and rising disposable incomes.

- Growth is driven by the hybrid work lifestyle, aging housing stock, and rising home equityfinancing projects.

- Key trends include the rapid integration of smart home technologyinto renovations and a strong consumer shift towards sustainable and eco-friendly products.