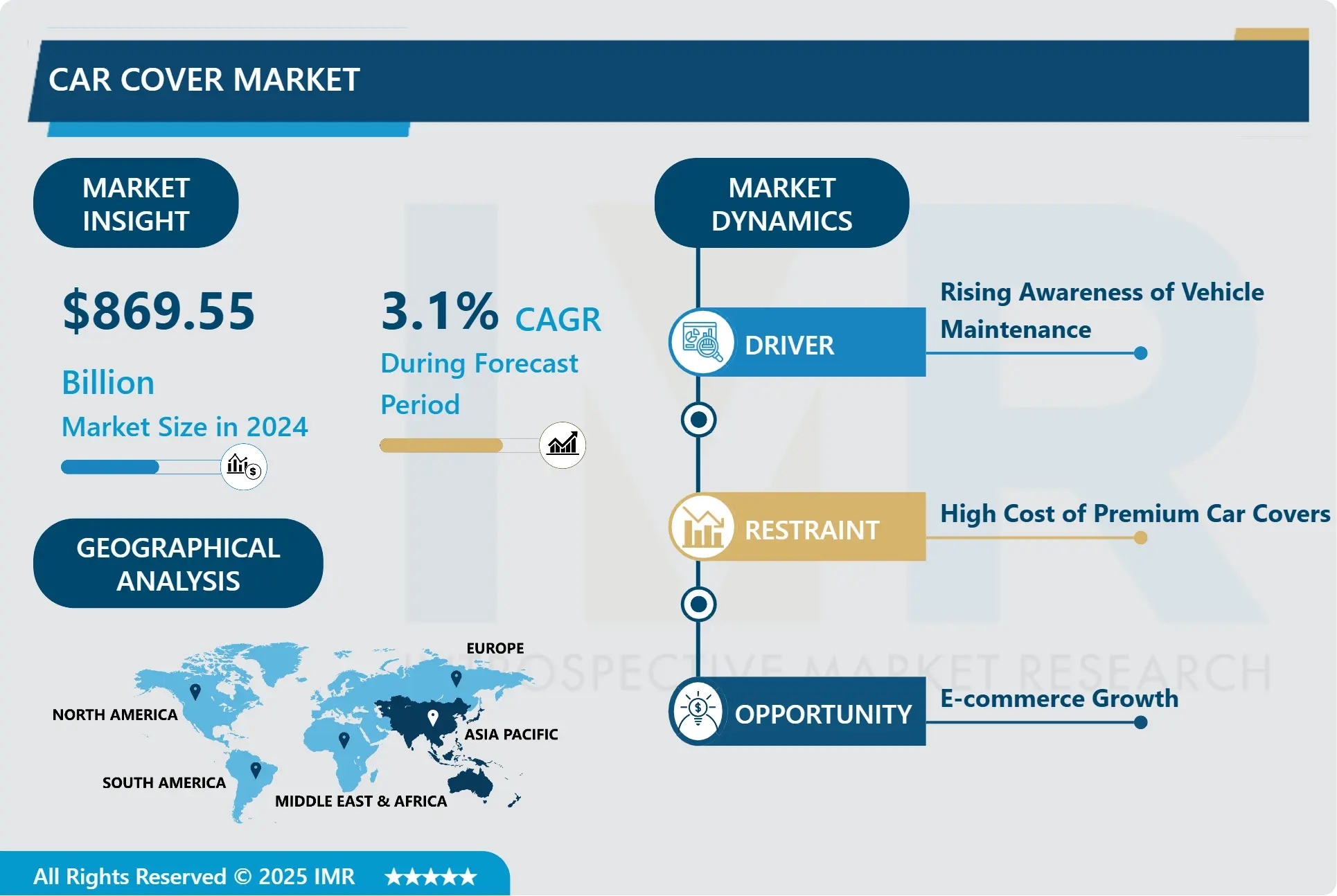

According to a new report published by Introspective Market Research, the Global Car Cover Market by Material, Vehicle Type, Distribution Channel, and End-User, valued at USD 869.55 Billion in 2024, is projected to reach USD 1,110.1 Billion by 2032, growing at a CAGR of 3.1% from 2025 to 2032. This steady expansion is fueled by the continued global growth in vehicle ownership, rising consumer awareness about vehicle preservation, increasing incidence of extreme weather events, and the growing value of vehicles as long-term assets requiring protection from environmental and incidental damage.

Car Covers are protective fabrics or materials designed to shield vehicles from a wide range of external elements. Modern covers offer significant advantages over basic tarpaulins or improvised protection, providing tailored fits, breathable materials to prevent moisture trapping, and specialized fabric technologies that offer UV resistance, water repellency, and scratch protection. They serve as a cost-effective first line of defense against sun damage, bird droppings, tree sap, dust, hail, and minor scratches, helping to preserve a vehicle's paint, interior, and resale value, especially for vehicles parked outdoors for extended periods.

A Key Growth Driver: Rising Vehicle Ownership and the Premiumization of Vehicle Care

A primary driver propelling the car cover market is the sustained global growth in personal vehicle ownership, particularly in emerging economies, coupled with an increasing "premiumization" of vehicle care and maintenance. As more households own vehicles, often as a significant financial investment, the incentive to protect that asset grows. Owners of new, luxury, and classic cars are especially motivated to prevent depreciation caused by environmental damage. Furthermore, the rise of vehicle subscription services and peer-to-peer car sharing platforms has created a commercial need to maintain vehicle condition between users. This cultural shift towards viewing vehicles as valuable assets requiring proactive preservation, rather than just disposable tools, sustains consistent demand for protective accessories like high-quality car covers.

A Key Market Opportunity: Development of Smart and Sustainable Car Cover Solutions

A significant market opportunity lies in innovating "smart" car covers with integrated technology and developing eco-friendly, sustainable products. Smart covers could incorporate sensors for security alerts (tamper detection), GPS tracking, or solar panels to trickle-charge a vehicle's battery, adding functionality beyond basic protection. On the sustainability front, there is growing consumer interest in covers made from recycled materials (e.g., recycled PET bottles), biodegradable fabrics, or those with a lower overall environmental footprint in production and disposal. Companies that can lead in either technological integration or verified sustainability credentials will differentiate themselves in a crowded market, appealing to tech-savvy and environmentally conscious consumers willing to pay a premium for advanced features.

The Car Cover Market is segmented on the basis of Material, Vehicle Type, Distribution Channel, and End-User.

Vehicle Type

The Vehicle Type segment is further classified into Passenger Cars, SUVs & MPVs, Light Commercial Vehicles, and Others. Among these, the Passenger Cars sub-segment accounted for the highest market share in 2024. This dominance is a direct reflection of the massive global population of passenger cars, which constitute the vast majority of the vehicle parc. The widespread ownership of sedans, hatchbacks, and coupes, combined with the common challenge of limited covered parking space for many owners, ensures that this segment generates the highest volume demand for universal and custom-fit car covers.

Distribution Channel

The Distribution Channel segment is further classified into Automotive Parts Retailers, Online Retail, Supermarkets/Hypermarkets, and Others. Among these, the Online Retail sub-segment accounted for the highest market share in 2024 and is expected to maintain its lead. E-commerce platforms are ideal for this product category due to the wide variety of sizes, materials, and vehicle-specific fits available. Consumers can easily search for exact makes and models, compare product specifications and prices, and read detailed reviews from other buyers. The convenience of home delivery for a relatively bulky item further solidifies online retail as the dominant purchasing channel.

Some of The Leading/Active Market Players Are:

- Covercraft Industries, LLC (USA)

- California Car Cover Co. (USA)

- Coverking (USA)

- Budge Industries (USA)

- Kimberly-Clark Corporation (USA) - (Evolution 4 brand)

- Rampage Products (USA)

- Classic Additions Ltd. (UK)

- Polco Pvt. Ltd. (India)

- Intro-Tech Automotive (USA)

- Mitsubishi Motors Corporation (Japan) - (Through accessories)

- S. Auto Parts Network, Inc. (USA)

- Exact Covers Ltd (UK)

- Empire Covers (USA)

- OxGord (USA)

- CarCapsule (USA)

and other active players.

Key Industry Developments

News 1: Strategic Partnership for Direct-to-Consumer Customization

In March 2024, Covercraft, a leader in custom-fit covers, announced a deepened partnership with a major online automotive accessories retailer. The collaboration integrates Covercraft's vehicle-specific design database directly into the retailer's website, allowing customers to seamlessly order perfectly tailored covers with custom embroidery options in a fully digital workflow.

This move enhances the online purchasing experience for custom products, reducing friction and potential errors in the ordering process. It represents a strategic focus on leveraging digital tools to capture the growing demand for personalized, high-quality vehicle protection solutions sold directly online.

News 2: Launch of a Weather-Responsive "All-Climate" Cover Line

In November 2023, a leading cover manufacturer launched a new line of "IntelliShield" car covers featuring a proprietary 5-layer fabric technology. The covers are marketed as dynamically responsive, claiming to offer superior breathability in humid conditions and enhanced water repellency during rain, based on the environmental conditions.

This product launch highlights competition through material science innovation. By developing and marketing advanced proprietary fabrics with specific performance claims, companies aim to move beyond commodity competition and justify higher price points for technically superior protection.

Key Findings of the Study

- The Passenger Carsvehicle type and Online Retail distribution channel dominate global market revenue.

- The Asia-Pacificregion is the largest market due to its enormous and growing vehicle population, while North America remains a high-value market with strong aftermarket spending.

- Key growth is driven by increasing global vehicle parc, rising consumer awareness of vehicle protection, and extreme weather occurrences.

- Major trends include the growth of online sales channels and consumer preference for custom-fit, vehicle-specific coversover universal sizes.

- The market is fragmented with numerous regional and international players, where brand reputation for fit, material quality, and durability are key competitive factors.