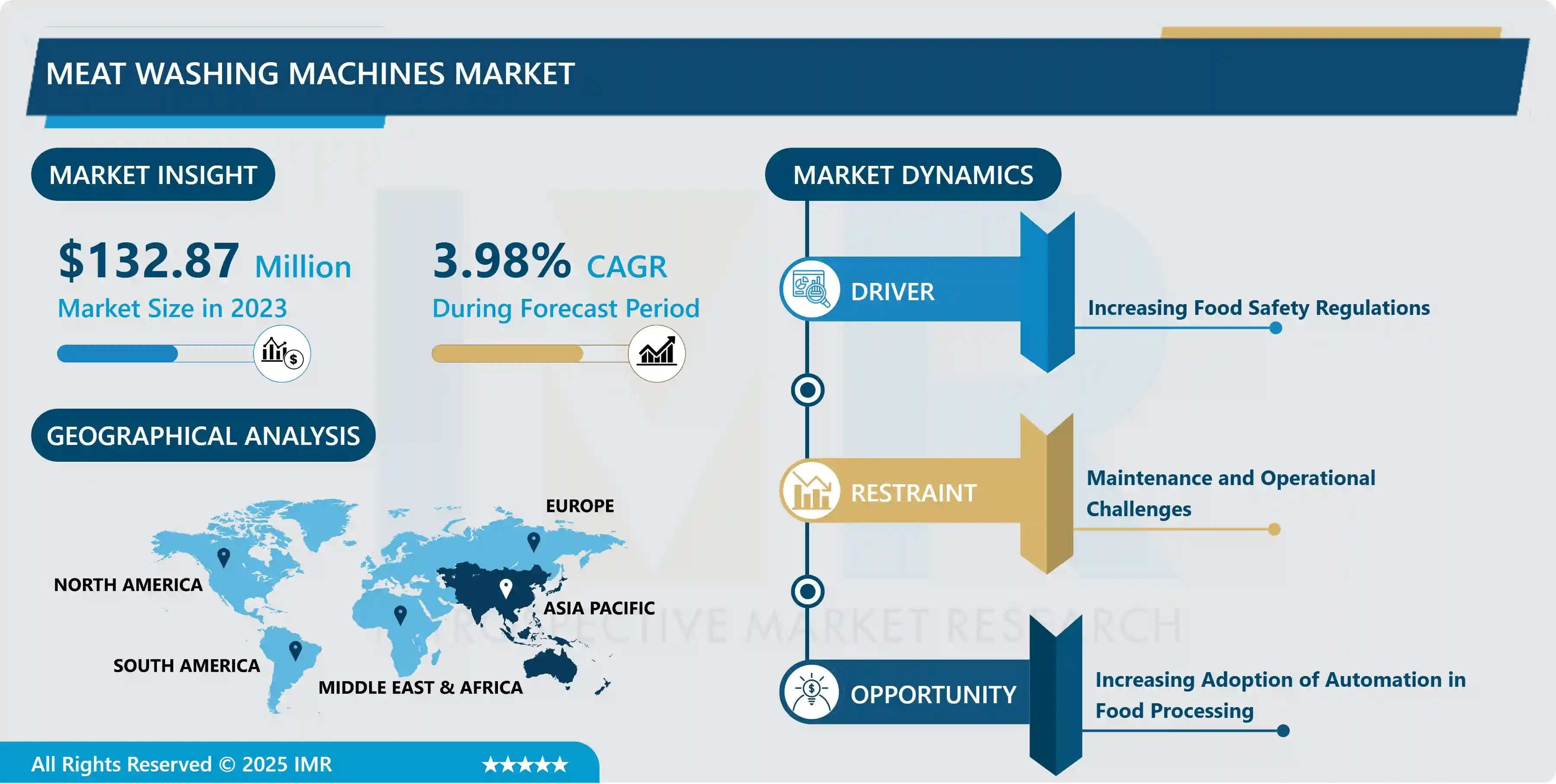

According to a new report published by Introspective Market Research, Meat Washing Machines Market by Product Type, Application, and Automation Level, The Global Meat Washing Machines Market Size Was Valued at USD 132.87 Million in 2023 and is Projected to Reach USD 188.79 Million by 2032, Growing at a CAGR of 3.98%.

Market Overview:

The global Meat Washing Machines Market is a specialized and critical segment within the food processing equipment industry, dedicated to the automated cleaning and sanitization of meat products, primarily carcasses, primal cuts, and offal. These machines offer a significant advantage over traditional manual washing methods by providing consistent, high-pressure, and high-volume cleaning that ensures superior hygiene, reduces microbial load (including pathogens like Salmonella and E. coli), and enhances the overall safety and shelf life of meat. They are indispensable for maintaining stringent food safety standards and optimizing operational efficiency in meat processing facilities.

Growth Driver:

The paramount growth driver for the meat washing machines market is the relentless global tightening of food safety regulations and heightened consumer awareness regarding meat-borne illnesses. Regulatory agencies worldwide are imposing stricter hygiene protocols and microbiological standards throughout the meat supply chain. Manual washing is inconsistent and fails to meet these rigorous requirements for pathogen reduction. Automated meat washing machines provide a validated, repeatable, and auditable solution to achieve the necessary decontamination levels, directly helping processors comply with regulations, avoid costly recalls and shutdowns, and protect brand reputation. This regulatory pressure makes the adoption of such specialized equipment not just an operational improvement but a compliance necessity.

Market Opportunity:

A significant market opportunity lies in the development and integration of smart, water-recycling, and multi-functional washing systems that address both efficiency and sustainability concerns. There is growing demand for machines that incorporate advanced features like UV-C light or ozone sterilization, automated chemical dosing based on real-time soil load detection, and closed-loop water systems that drastically reduce water consumption. Furthermore, systems that can handle multiple processing steps—such as washing, massaging, and tenderizing in a single unit—offer value by saving space and streamlining production lines. Manufacturers that can provide intelligent, sustainable, and versatile solutions will capture market share from processors aiming to lower their environmental footprint and total cost of ownership.

The Meat Washing Machines Market is segmented on the basis of Product Type, Application, and Automation Level.

Product Type

The Product Type segment is further classified into Carcass Washing Machines, Offal Washing Machines, and Cut Parts Washing Machines. Among these, the Carcass Washing Machines sub-segment accounted for the highest market share in 2023. This dominance is due to the critical and mandatory nature of carcass washing as the first and most crucial decontamination step after slaughter. These high-capacity machines are designed to handle whole beef, pork, or lamb carcasses, using high-pressure sprays to remove blood, debris, and surface contaminants. Their central role in the primary processing line and their direct impact on the safety of all subsequent meat products make them the largest and most essential equipment category.

Application

The Application segment is further classified into Beef, Pork, Poultry, and Others. Among these, the Poultry sub-segment accounted for the highest market share. The poultry industry is the largest and most vertically integrated meat sector globally, characterized by high-volume, high-speed processing lines. The susceptibility of poultry to pathogens like Campylobacter and Salmonella necessitates rigorous washing at multiple stages (e.g., after evisceration, before chilling). The scale of poultry production and the stringent regulatory focus on its safety drive the highest demand for efficient, automated washing solutions tailored for birds of various sizes.

Some of The Leading/Active Market Players Are-

• Marel (Iceland)

• JBT Corporation (USA)

• GEA Group AG (Germany)

• BAADER Group (Germany)

• Key Technology, Inc. (USA)

• Heat and Control, Inc. (USA)

• Prime Equipment Group, Inc. (USA)

• Cantrell International (USA)

• Jarvis Products Corporation (USA)

• CTB, Inc. (USA)

• Meyn Food Processing Technology B.V. (Netherlands)

• SFK Danmark A/S (Denmark)

• Linco Food Systems (USA)

• SSEC, Inc. (USA)

• and other active players.

Key Industry Developments

News 1:

In January 2024, Marel launched a new intelligent "CleanFlow" poultry washing system with integrated AI vision for contamination detection.

The system uses cameras and AI algorithms to identify residual contaminants on carcasses and automatically adjusts water pressure, temperature, and sanitizer concentration in real-time. This innovation aims to optimize cleaning efficacy while reducing water and chemical usage by up to 30%, targeting both efficiency and sustainability.

News 2:

In March 2024, GEA Group introduced a new modular, multi-species carcass washing system designed for mid-sized processors.

The new system offers flexibility to handle beef, pork, and lamb on the same line with quick changeover capabilities. It focuses on reducing installation footprint and operational complexity, making advanced automated washing technology more accessible and cost-effective for regional slaughterhouses and processors.

Key Findings of the Study

• The Carcass Washing Machines product type segment holds the dominant market share as the foundational hygiene step.

• The Poultry application segment is the largest, driven by high-volume processing and stringent pathogen control needs.

• Market growth is primarily fueled by stringent global food safety regulations and the need for pathogen reduction.

• Key trends include the integration of smart sensors/AI for process optimization and a strong focus on water/energy-efficient designs.

• North America and Europe are leading markets due to advanced regulatory frameworks, with Asia-Pacific showing robust growth.