"What’s Fueling Executive Summary Digital Banking Market Market Size and Share Growth

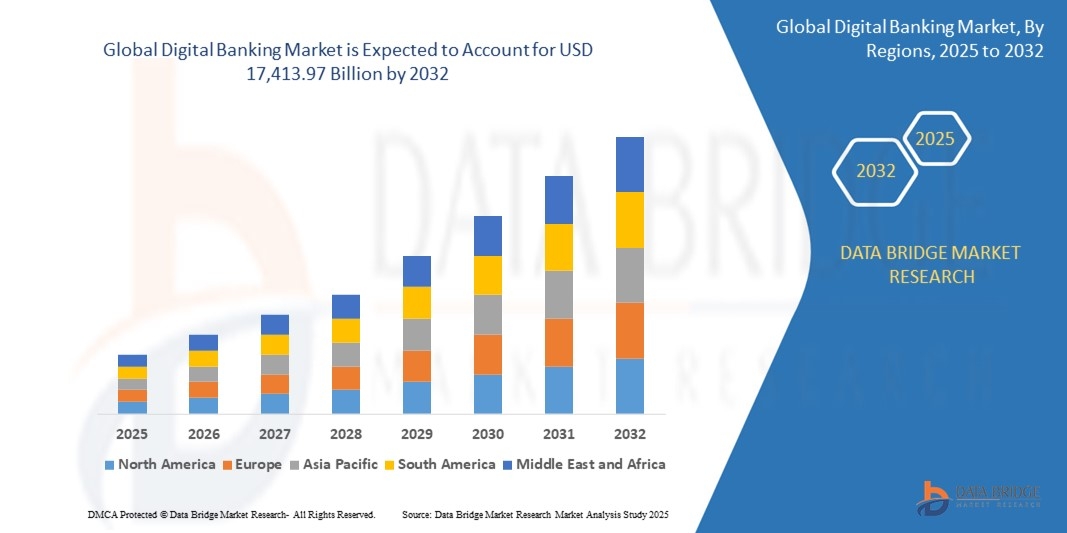

- The global digital banking market was valued at USD 9,800.46 billion in 2024 and is expected to reach USD 17,413.97 billion by 2032

Digital Banking Market Market research report has been produced with the systematic gathering and estimation of market information for Digital Banking Market Market All this information is supplied in such a form that properly gives explanation of various facts and figures to the business. The market data described in the report helps to make out diverse market opportunities present worldwide for Digital Banking Market Market industry. This report endows with accurate information about market trends, industrial changes, and consumer behavior etc. Taking up such market research report is always gainful for any company, whether it is a small scale or large scale, for marketing of products or services. Analytical study of the winning Digital Banking Market Market report supports in mapping growth strategies to increase sales and build brand image in the market.

The credible Digital Banking Market Market report offers company profiles and contact information of the key market players in the key manufacturer’s section. This market document showcases the list of top competitors and gives the insights on strategic industry analysis of the key factors affecting the market. This is the most relatable, exclusive, and commendable market research report formulated by focusing on definite business needs. Moreover, market status at the global and regional level is provided through this report which helps to achieve business insights at the extensive marketplace. For an excellent outcome of Digital Banking Market Market report, qualitative and transparent research studies are carried out devotedly for the specific niche.

Navigate the evolving landscape of the Digital Banking Market Market with our full analysis. Get your report:

https://www.databridgemarketresearch.com/reports/global-digital-banking-market

Digital Banking Market Market Outlook & Forecast

Segments:

- By Banking Type: Retail Banking, Corporate Banking

- By Service: Transactional Services, Non-Transactional Services

- By Deployment: On-Premises, Cloud

The global digital banking market is segmented based on banking type, service, and deployment. The two main categories under banking type are retail banking and corporate banking, catering to individuals and businesses, respectively. Within services, digital banking offers both transactional and non-transactional services, including fund transfers, bill payments, account management, and financial planning. Moreover, based on deployment, digital banking solutions can be implemented on-premises or on the cloud, providing flexibility and scalability to financial institutions.

Market Players:

- Alkami Technology Inc.

- Appway AG

- Backbase

- CREALOGIX

- ebankIT

- Finastra

- Fiserv, Inc.

- Intellect Design Arena Ltd.

- Kony, Inc.

- NETinfo Plc

- NF Innova

- Oracle

- SAP SE

- Sopra Banking Software

- Temenos Headquarters SA

- Tata Consultancy Services Limited

Some of the key market players in the global digital banking market include Alkami Technology Inc., Appway AG, Backbase, CREALOGIX, ebankIT, Finastra, Fiserv, Inc., Intellect Design Arena Ltd., Kony, Inc., NETinfo Plc, NF Innova, Oracle, SAP SE, Sopra Banking Software, Temenos Headquarters SA, and Tata Consultancy Services Limited. These companies offer a wide range of digital banking solutions and services, catering to the evolving needs of banks and financial institutions in today's digital age.

The global digital banking market is witnessing significant growth driven by technological advancements, changing consumer preferences, and increasing digitalization in the banking sector. Companies operating in this market are continuously innovating to offer cutting-edge solutions that enhance customer experiences, streamline operations, and improve efficiency. With the rise of digital transformation initiatives in the financial services industry, the demand for digital banking solutions is expected to continue expanding across various regions. Market players are focusing on developing user-friendly interfaces, robust security measures, and personalized services to stay competitive in the dynamic landscape of digital banking.

One of the key trends in the digital banking market is the increasing adoption of cloud-based solutions. Cloud deployment offers several benefits, including cost-effectiveness, scalability, and agility, enabling financial institutions to quickly adapt to changing market dynamics and customer demands. Cloud-based digital banking solutions also facilitate remote access, data integration, and real-time analytics, empowering banks to deliver seamless and responsive services to their customers. As more banks transition from traditional on-premises systems to cloud-based platforms, the market is expected to witness accelerated growth in the coming years.

Another significant trend shaping the digital banking market is the emphasis on personalized customer experiences. Banks are leveraging data analytics, artificial intelligence, and machine learning technologies to gain actionable insights into customer behavior, preferences, and needs. By leveraging these insights, financial institutions can offer tailored products, personalized recommendations, and proactive services that resonate with individual customers. Personalization not only enhances customer engagement and loyalty but also drives revenue growth and competitive advantage in the digital banking landscape.

Moreover, the digital banking market is witnessing a surge in partnerships and collaborations among market players to expand their geographical presence, enhance product offerings, and accelerate innovation. Collaboration between fintech startups, traditional banks, and technology providers is fostering a culture of innovation and experimentation, leading to the development of novel solutions that address the evolving needs of customers. These strategic partnerships enable market players to combine their expertise, resources, and capabilities to deliver holistic digital banking experiences that cater to diverse customer segments and market requirements.

In conclusion, the global digital banking market is evolving rapidly, driven by technological advancements, changing consumer expectations, and industry collaborations. Market players are focusing on offering innovative solutions that enhance customer experiences, improve operational efficiency, and drive business growth. With the continued adoption of cloud-based platforms, the emphasis on personalized services, and the rise of strategic partnerships, the digital banking market is poised for robust growth and transformation in the years to come.The global digital banking market is undergoing a significant transformation driven by various factors such as technological advancements, changing consumer behaviors, and increasing digitalization across the banking sector. One of the key trends shaping the market is the growing emphasis on personalized customer experiences. Banks are leveraging advanced technologies like data analytics, artificial intelligence, and machine learning to understand customer preferences and provide tailored services. By offering personalized products and recommendations, financial institutions can enhance customer engagement, loyalty, and ultimately drive revenue growth.

Another important trend in the digital banking market is the increasing adoption of cloud-based solutions. Cloud deployment offers financial institutions cost-effectiveness, scalability, and agility, allowing them to adapt quickly to changing market dynamics and meet evolving customer demands. Cloud-based digital banking solutions also enable remote access, real-time analytics, and data integration, empowering banks to deliver seamless and responsive services to their customers. As more banks shift towards cloud-based platforms, the market is expected to witness accelerated growth in the coming years.

Moreover, strategic partnerships and collaborations among market players have become a prominent driver of innovation in the digital banking industry. Fintech startups, traditional banks, and technology providers are joining forces to expand their geographical presence, enhance their product offerings, and drive innovation. These partnerships enable companies to combine their strengths, resources, and capabilities to deliver comprehensive digital banking solutions that cater to a diverse range of customer segments and market needs. By fostering a culture of collaboration and experimentation, these partnerships are leading to the development of novel solutions that address the evolving expectations of customers in the digital banking landscape.

In conclusion, the global digital banking market is experiencing rapid evolution, fueled by advancements in technology, changing customer preferences, and strategic collaborations among industry players. The market is witnessing a shift towards personalized customer experiences, cloud-based solutions, and innovative partnerships that aim to revolutionize the way banking services are delivered and consumed. As companies continue to innovate and adapt to the digital age, the future of digital banking holds immense potential for growth, transformation, and enhanced customer value propositions.

Inspect the market share figures by company

https://www.databridgemarketresearch.com/reports/global-digital-banking-market/companies

Digital Banking Market Market Research Questions: Country, Growth, and Competitor Insights

- How much has the Digital Banking Market Market grown year over year?

- What is the future size forecast for the global Digital Banking Market Market?

- What are the dominant segment types by revenue in Digital Banking Market Market?

- Which companies hold a competitive edge for Digital Banking Market Market?

- What regional data is emphasized in the Digital Banking Market Market study?

- What international brands are featured for the Digital Banking Market Market?

Browse More Reports:

Global Laser Plastic Welding Market

Global Medical Aesthetic Market

Global Smartwatch Market

Global Titanium Market

Global Water Purifiers Market

India Baby Care Products Market

India Smart Water Meter Market

India White Goods Market

Saudi Arabia Glass Market

Global Additive Manufacturing Market

Global Digital Banking Market

Global IP-VPN Web Hosting Service Market

Global Mobile Money Market

Malaysia Elderly Care Market

Global Energy Drinks Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"